Social security windfall elimination calculator

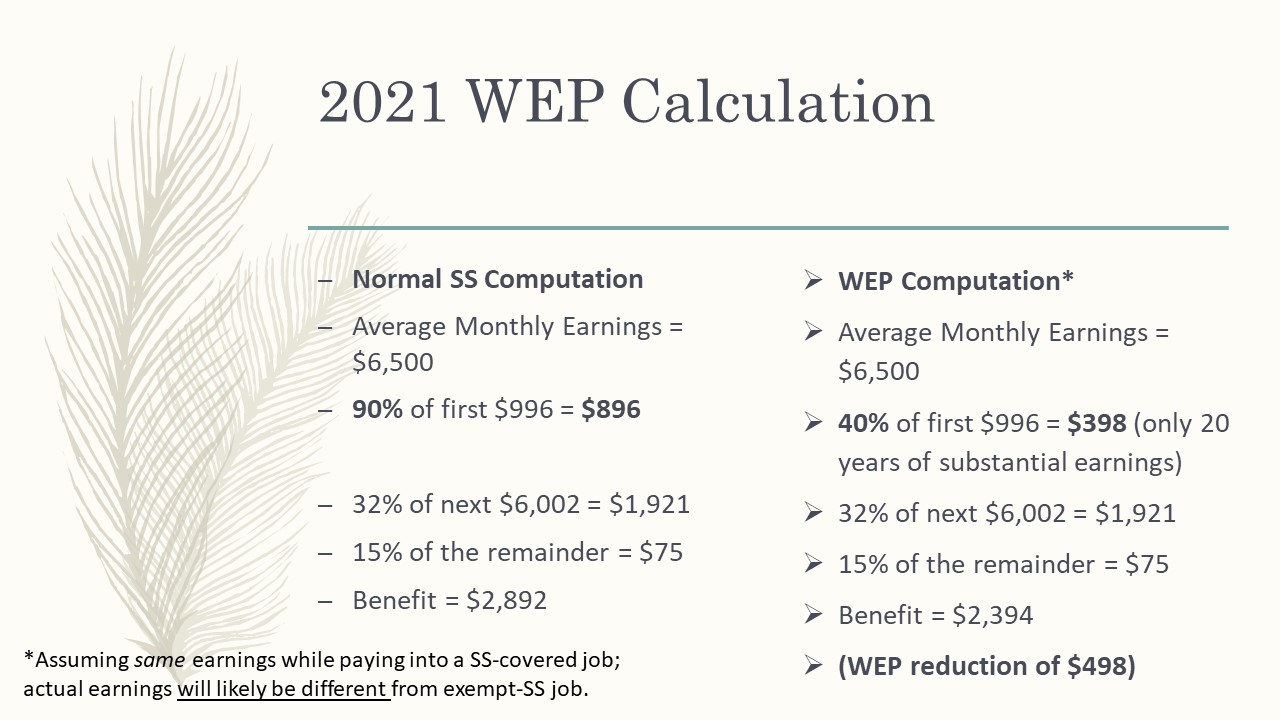

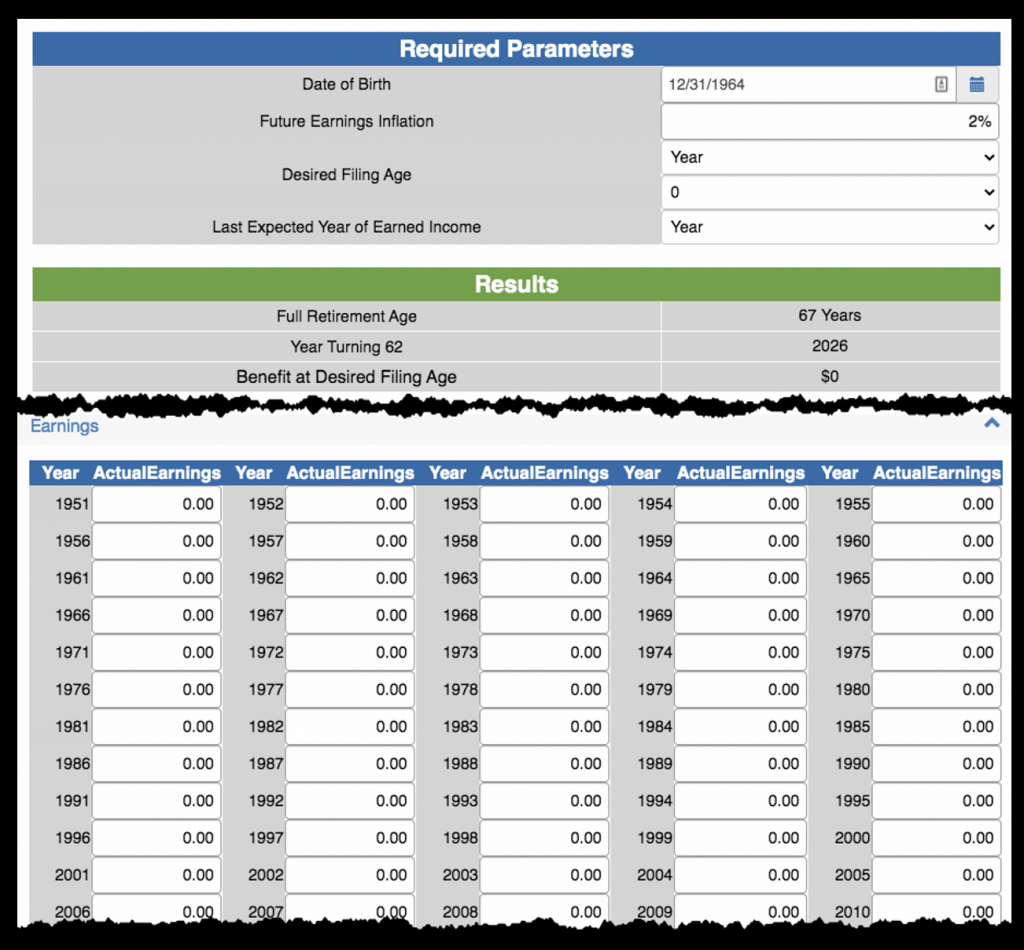

They worked at another job where they qualified for Social Security benefits. To use the Online Calculator you need to enter all your earnings from your online Social Security.

Everything You Need To Know About Social Security Retirement Benefits Simplywise

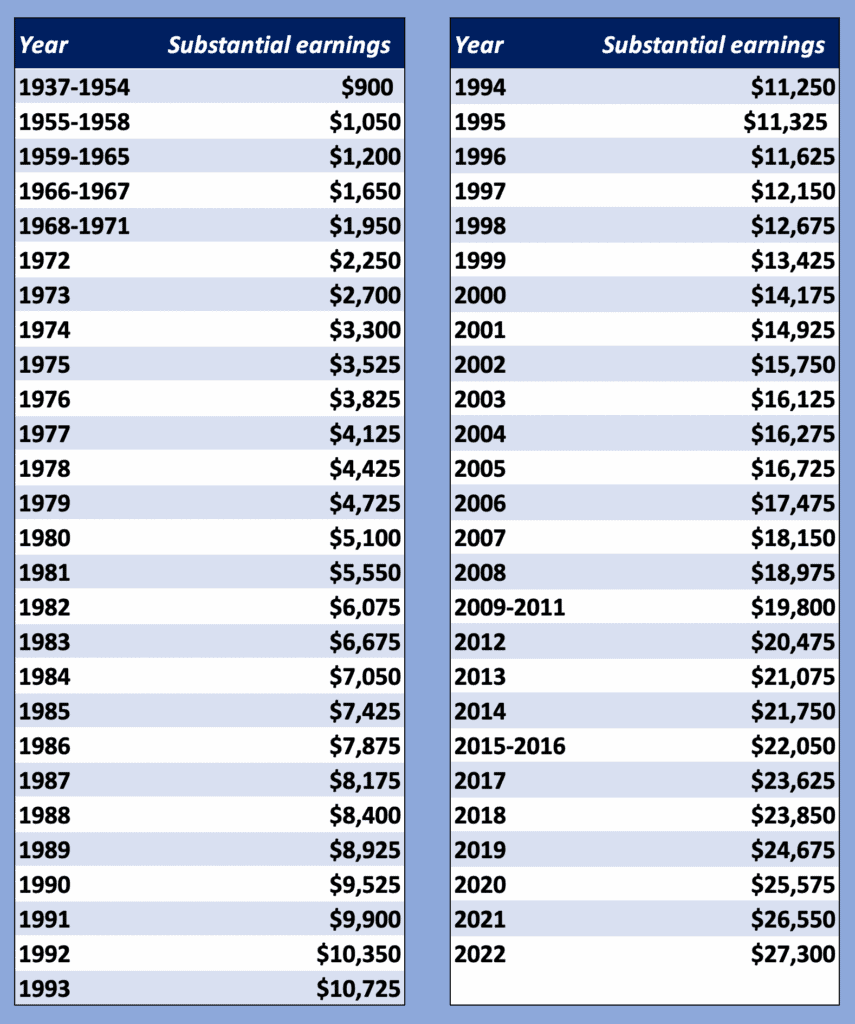

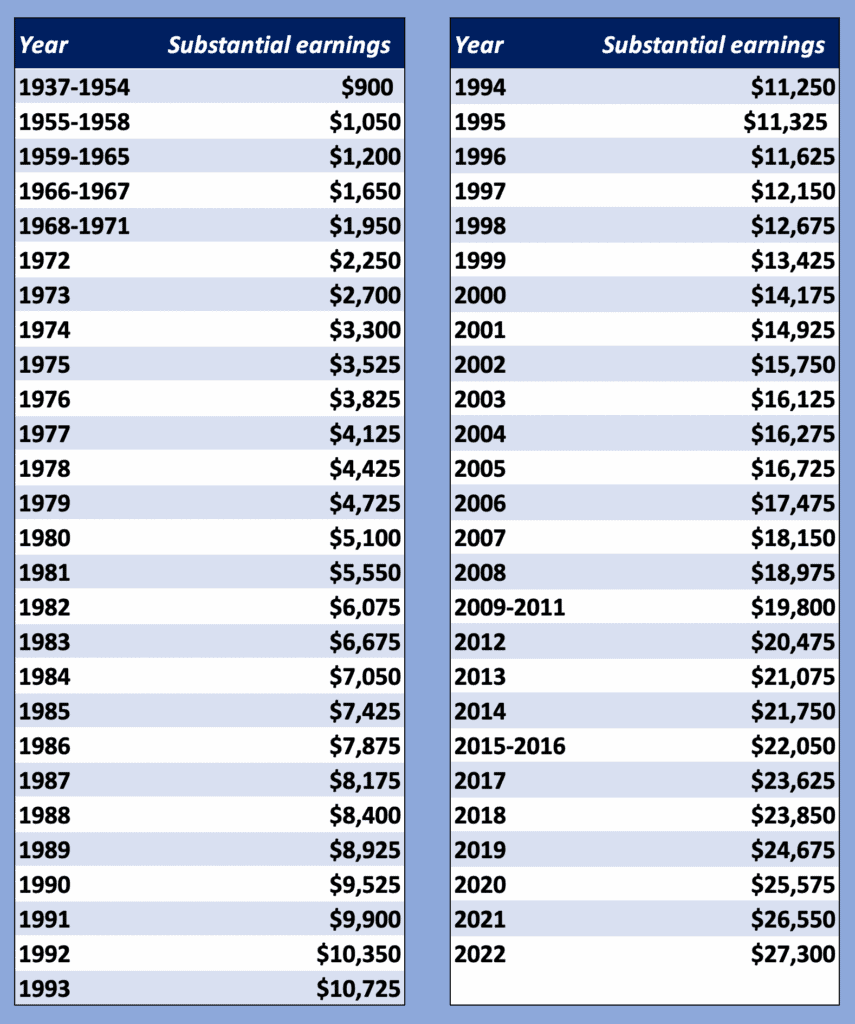

The WEP formula takes into account the number of years you did have Social Security taxes withheld.

. The Online Calculator below allows you to estimate your Social Security benefit. The amount of Social Security benefit you can expect. Teachers are one of the most common groups to be impacted by this rule but it often includes other public sector.

Anyone who has paid into Social Security at some point in their career can use this app including those affected by the Windfall Elimination Provision. 444 556 of 800 396 250 50 of 500 So your WEP penalty is 250 which reduces your FRA SS benefit from 800 to 550. Employer who didnt withhold Social Security taxes.

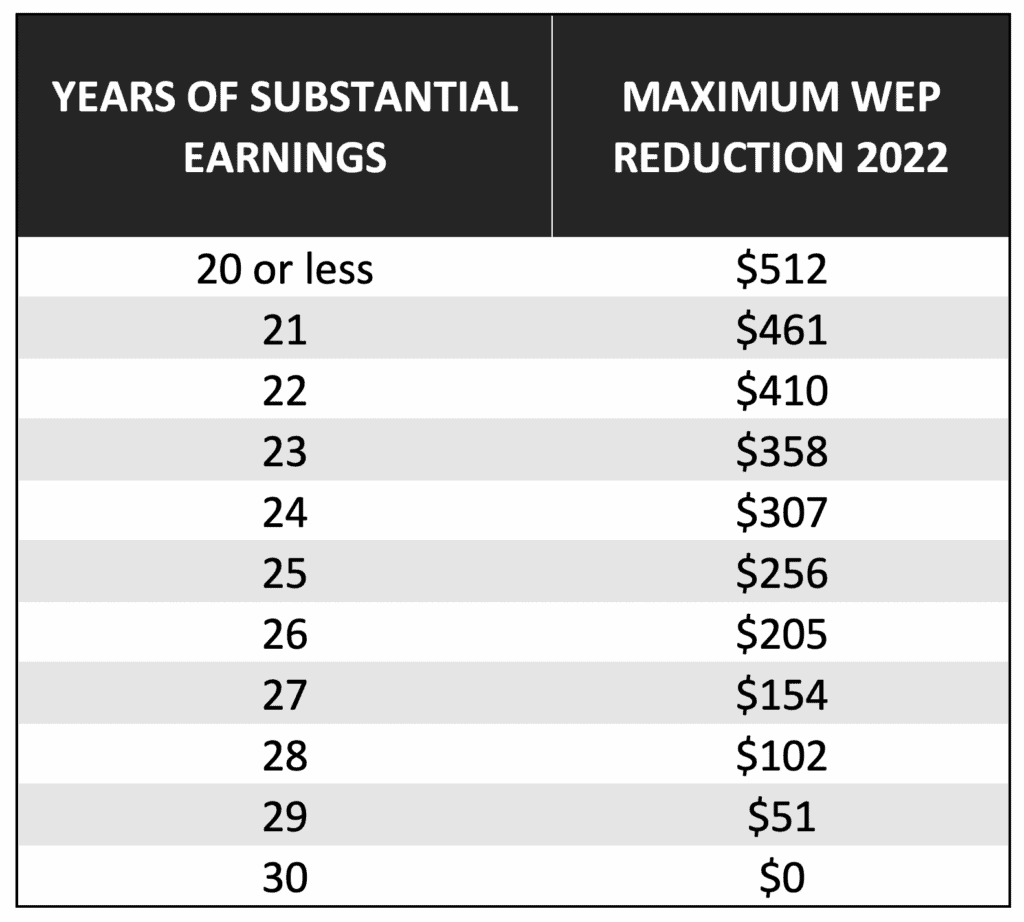

This calculator will tell you. The Windfall Elimination Provision WEP is poorly understood and catches a lot of people by surprise. If you do not have 30 years of.

It then uses a sliding scale to determine your eligibility year ELY. 35 rows Your age 62 retirement benefit is 618 884 x 70 618 per month. The windfall elimination provision affects how the amount of your retirement or disability benefits is calculated if you receive a pension from work where Social Security taxes were not taken out of your pay.

Who can use this app. Next in the above example lets change the nonSS. You qualify for Social Security retirement or disability benefits from work in other jobs for which you did pay taxes.

The Windfall Elimination Provision WEP is a formula that can reduce the size of your Social Security retirement or disability benefit if you receive a pension from a job in which. A modified formula is used to calculate your benefit amount resulting in a lower Social Security benefit. The Social Security WEP Calculator The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid. Social Security benefits are based on the workers average monthly earnings. Social Securitys website provides a calculator to help you gauge the impact on your benefits from the Windfall Elimination Provision WEP the rule that reduces retirement.

The most your Social Security Benefit will be reduced with 20 years of substantial earnings in 2019 is 463.

Social Security What Is The Windfall Elimination Provision How Does It Affect Your Benefits

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Sers

When To Claim Social Security Calculators

How The Government Pension Offset And Windfall Elimination Provision Affects Dually Entitled Spouses Social Security Intelligence

Windfall Elimination Provision Wep Csrs Social Security Adjustment

How Does Government Pension Offset Work Smartasset

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

Social Security S Windfall Elimination Provision

Calculators Social Security Intelligence

Social Security Just Emailed Us About Their Website Upgrade Here S What They Didn T Say

How To Calculate Your Social Security Benefits A Step By Step Guide Social Security Intelligence

Downloadable Social Security Benefit Estimator Bogleheads Org

Social Security Wep Fomo Idk Or Lol Retirement Insight And Trends

Is There A Benefit To Using A Social Security Calculator A M Stutts Financial Management Llc

Calculators Social Security Intelligence

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence